Lawmakers look to repeal MTA Payroll tax

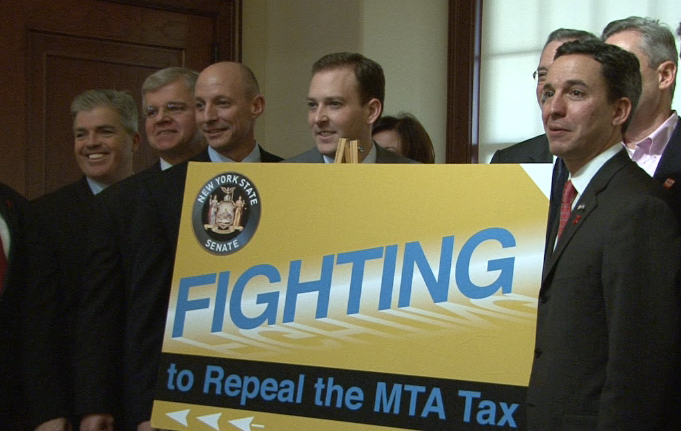

Lawmakers huddled together at the Theodore Roosevelt Executive & Legislative Building in Mineola on Friday to announce state legislation that would exempt local governments from paying the controversial MTA payroll tax, which was once again criticized by some local officials as a “job-killing tax.”

If passed, the bill will no longer require Nassau and Suffolk counties, including towns and villages within their borders, from paying the .34 percent tax per $100 of payroll to pay the Metropolitan Transportation Authority. The tax currently provides more than $1 billion in annual support to the MTA.

The state Senate version of the bill is sponsored by Sens. Jack Martin (R-Mineola) and Lee Zeldin (R-Shirley). A similar bill is also in the state Assembly.

“We can all understand that we have to support our local municipalities to pave our roads, to keep pour parks operated,” said Martins. “What we can’t accept is that our taxes are going to support a third-party like the MTA.”

Nassau and Suffolk County executives Ed Mangano and Steve Bellone, as well as mayors, village trustees and other members of local government joined the senators to back the repeal of the MTA payroll tax, which was signed into law in 2009. The group of mostly Republicans were flanked by two mustard-colored signs that read “Fighting to repeal the MTA Tax.”

Bellone, one of the few Democrats in attendance, said the proposed bill was a “big step” to provide tax relief to the county.

“We’re all dealing with financial difficulties at every level in government,” he added. “But the most important thing that we need to do to address that issue…is to grow this economy.”

The move to repeal the tax comes just one month after Governor Andrew Cuomo signed a bill into law that eliminated the tax for nearly 80 percent of businesses with a payroll of $1.25 million or less, as well as public and private schools.

On Friday, officials set their sights on the remaining 20 percent of the payroll tax and slammed it as an “unfair” burden for local businesses, and for the residents who don’t use MTA services, but see their taxes go toward subsidizing mass transit.

“Clearly there is room in the MTA for additional efficiencies to absorb the dollars that would come back to our counties,” Mangano said.

But in a statement released through a spokesman, the MTA said the tax “provides a vital $1.2 billion in annual support for public transportation across the downstate region—13 times more money than was saved by the 2010 service reductions.

“The MTA’s focus is on using this revenue as efficiently as possible, which we are achieving by identifying savings projected to reach $1 billion annually by 2014,” the statement read.

Officials said instead of using tax dollars to subsidize the MTA, the money could be better served to alleviate problems within county government.

Hempstead Town Supervisor Kate Murray said the payroll tax results in about $600,000 being funneled to the MTA from Long Island’s most populous town.

“That money can go to much better causes,” she said.

A spokesperson for Cuomo wasn’t immediately available for comment.